Comprehending the Price Savings of Medicare Benefit Insurance Coverage

As people navigate the complicated landscape of medical care insurance options, comprehending the subtleties of cost savings within Medicare Advantage intends ends up being significantly essential. By delving into the ins and outs of exactly how Medicare Advantage plans attain these financial savings, people can get important insights into maximizing their health care insurance coverage while possibly decreasing out-of-pocket expenditures.

Benefits of Medicare Benefit Program

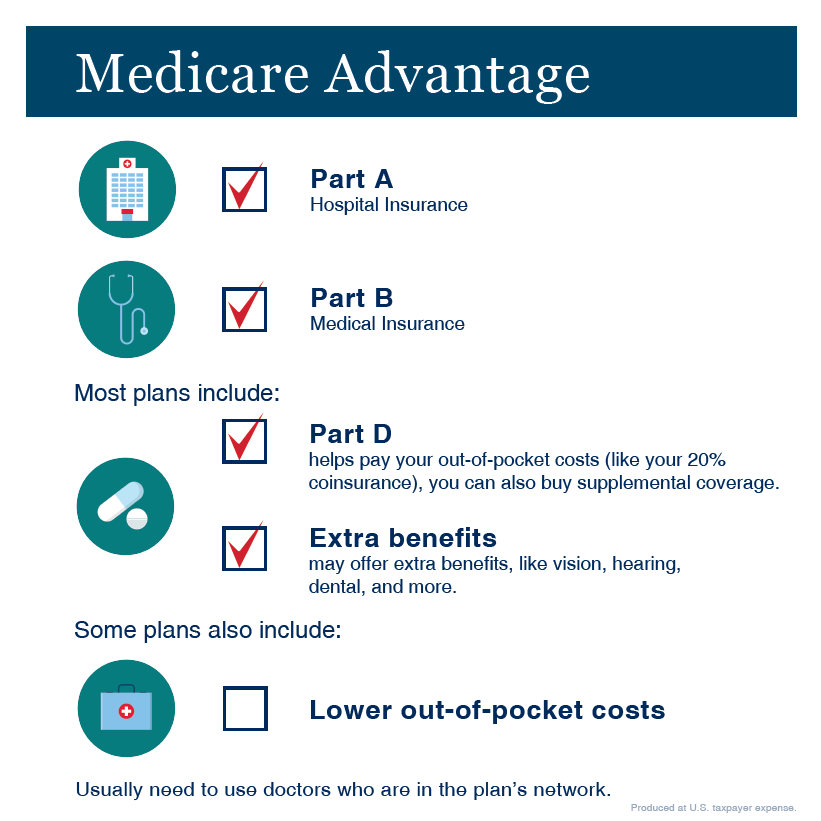

Medicare Benefit plans deal an extensive selection of benefits that go beyond standard Medicare insurance coverage, providing enrollees with improved healthcare services and cost-saving possibilities. These strategies often consist of coverage for solutions such as oral, vision, hearing, and prescription medicines, which are not commonly covered under original Medicare. By consolidating these different medical care needs right into one strategy, Medicare Benefit recipients can take pleasure in the ease of having all their clinical solutions covered under a single plan.

In Addition, Medicare Advantage plans often include added benefits like health club memberships, telehealth services, and health care to promote preventative care and general wellness. These value-added advantages intend to boost the quality of look after enrollees while additionally helping them reduce out-of-pocket expenses that they might or else incur with standard Medicare.

Basically, the advantages of Medicare Advantage intends expand beyond fundamental medical protection, supplying a much more all natural technique to health care that concentrates on safety nets, ease, and cost-effectiveness for beneficiaries.

Cost-efficient Protection Options

The boosted benefits provided by Medicare Advantage intends not just improve healthcare protection however likewise existing beneficiaries with a series of affordable coverage options to think about. These plans commonly include added advantages past Initial Medicare, such as vision, oral, hearing, and prescription medicine coverage, all packed right into one detailed plan (Medicare advantage plans near me). By supplying these extra services, Medicare Benefit strategies can help individuals save cash by lowering out-of-pocket expenses that would certainly otherwise be incurred separately

Additionally, some Medicare Benefit plans have reduced regular monthly premiums contrasted to conventional Medicare, making them an appealing option for those looking to handle their health care expenses efficiently. The affordable coverage alternatives available through Medicare Benefit plans can offer recipients with comprehensive health care coverage while potentially saving them money over time.

Possible Out-of-Pocket Cost Savings

Additionally, Medicare Benefit intends typically consist of additional advantages not covered by Initial Medicare, such as vision, dental, hearing, and prescription drug coverage. By packing these solutions right into one thorough strategy, beneficiaries can save cash on out-of-pocket expenses that would otherwise be sustained if they had to buy linked here different insurance coverage or pay for services out of pocket.

Value-added Solutions and Perks

Value-added solutions and benefits offered by Medicare Benefit intends boost the general healthcare experience for plan members. These extra services exceed what Original Medicare covers, using bonus such as vision, dental, listening to protection, fitness programs, and even prescription drug insurance coverage in some instances. By integrating these supplementary advantages, Medicare Advantage plans aim to provide extensive treatment that attends to not only clinical requirements but also general wellness.

In Addition, some Medicare Benefit strategies might supply telehealth solutions, which have actually come to be progressively useful in today's electronic age. This permits strategy members to talk to healthcare carriers remotely, saving time and money while making sure access to needed clinical interest. Medicare advantage plans near me. Furthermore, several strategies give treatment control services, aiding members browse the complexities of the healthcare system and ensuring they get appropriate and timely treatment

Factors Affecting Price Cost Savings

Aspects affecting cost look at this now financial savings within Medicare Benefit plans are essential to understand for both carriers and recipients. One more variable is the network structure of Medicare Benefit plans, which usually have agreements with particular medical care suppliers to provide services at worked out prices. Understanding these elements can aid service providers and recipients make informed choices to optimize price savings while keeping high quality care within Medicare Benefit strategies.

Final Thought

:max_bytes(150000):strip_icc()/Primary-Image-pitfalls-medicare-advantage-plans-e0b4733752d84973b8baad075834c35a.jpg)